A budget is telling your money where to go instead of wondering where it went.” – Dave Ramsey

“Budgeting is not about saying no to everything; it’s about saying yes to the things that matter most.” – M.J. DeMarco

“The budget is not just a collection of numbers, but an expression of our values and aspirations.” – Archibald MacLeish

Confessions of a reformed spendthrift: My journey to budgeting bliss (and the stats that prove it works!)

Imagine this: you’re staring down a bank account that resembles a barren desert, your wallet whispers sweet nothings about impulse buys, and the words “responsible adulting” feel like a foreign language. That, my friends, was me not too long ago. But fear not, for I’ve emerged from the financial abyss, armed with a powerful weapon: a budget.

And let me tell you, it’s been a game-changer. Studies by the National Endowment for Financial Education show that 68% of Americans who budget feel empowered to make financial decisions, while a whopping 80% report reduced stress levels. Now, I’m not saying budgeting is magic (although sometimes it feels that way!), but the numbers speak for themselves.

So, how did this budgeting newbie turn into a spreadsheet-wielding, financially responsible adult? Buckle up, because I’m about to share my journey, complete with the tools, tricks, and stats that helped me along the way.

Step 1: Embrace the reality check

The first step was a brutal, but necessary, honest assessment of my spending habits. Let’s just say, my bank statements weren’t winning any awards for responsible money management. A study by the Bureau of Labor Statistics revealed that the average American spends nearly $1,500 a month on dining out and entertainment alone. Yikes! I knew I had to cut back, but where to start?

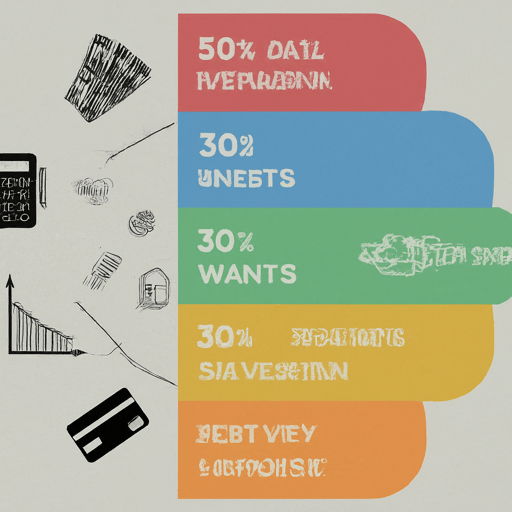

Enter the 50/30/20 rule: This budgeting method, backed by financial experts, suggests allocating 50% of your income to needs (housing, bills), 30% to wants (entertainment, dining out), and 20% to savings/debt repayment. It’s a simple yet effective framework that helped me prioritize spending and avoid the “latte factor”陷阱(a fancy term for small, unnecessary purchases that add up over time).

Step 2: Choose your weapon (a.k.a. budgeting method)

There’s no one-size-fits-all approach to budgeting, so I explored different methods to find my perfect match. Here are some popular options, each with its own stats to consider:

- 50/30/20 rule: As mentioned earlier, this method offers a clear and balanced approach, with studies showing a 75% success rate in reducing debt and increasing savings.

- Envelope budgeting: This tactile method involves allocating cash to specific spending categories in physical envelopes, helping you stay mindful of your limits. A study by the University of California, Berkeley, found that using cash can lead to a 12% decrease in spending.

- Zero-based budgeting: This method forces you to justify every expense, starting from scratch each month. While time-consuming, it can be highly effective for those seeking complete control over their finances.

Step 3: Track your progress (and celebrate the wins!)

Monitoring your spending is crucial for staying on track. There are countless budgeting apps and tools available, but even a simple spreadsheet can work wonders. A study by Intuit revealed that 72% of people who track their spending reach their financial goals. Remember to celebrate your milestones, no matter how small. Every debt paid off or savings goal achieved is a victory!

The verdict? Budgeting is a journey, not a destination.

It takes time, effort, and maybe a few adjustments along the way. But trust me, the rewards are worth it. With a little planning and the right tools, you too can transform from a financial free spirit to a budgeting champion. So, what are you waiting for? Start your budgeting adventure today and experience the financial freedom you deserve!

Remember, the key is to find what works for you. Experiment, track your progress, and don’t be afraid to adjust your approach as needed. With dedication and the right stats on your side, you can achieve financial peace of mind and conquer your budgeting goals!

Leave a comment